ECB’s asset Purchase Programmes

Goldman Sachs Analysis about ECB’s asset purchase programmes

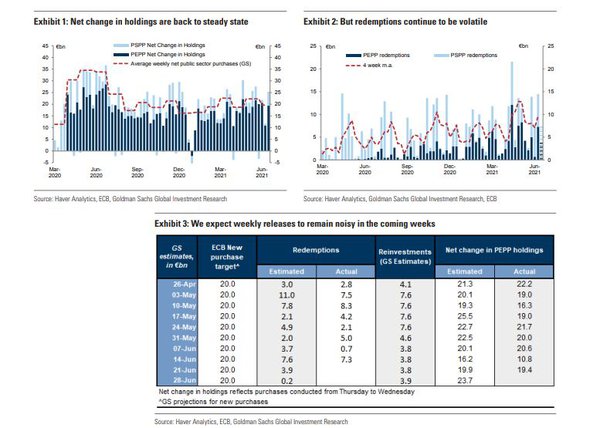

The weekly release of holdings under the ECB’s asset purchase programmes showed a net increase in PEPP holdings of EUR 19.4bn for the week ending on June 18th, back in line with the post-March average after a drop last week. Looking ahead to Q3, despite the ECB in their June meeting having maintained their language of a ‘significantly higher’ PEPP pace, we continue to expect seasonally lower issuance volumes in the summer months (especially August) to push the average Q3 pace down slightly to EUR 75bn/month.

ECB’s asset purchase programmes

MAIN POINTS: 1. The weekly release of PEPP flows data, reflecting purchases conducted between the 10th and 16th of June, showed a net increase in holdings under the PEPP of EUR 19.4bn. This figure is in line with the post-March meeting average, after a drop last week likely due to high redemptions under both the PSPP and PEPP programs. 2. We estimate lower redemptions this week (from EUR 7.3bn to EUR 3.9bn) and assuming stable reinvestments throughout June at EUR 3.8bn, this would translate into a net underlying purchase pace in line with ECB guidance of a PEPP pace that remains “significantly higher” in Q3 compared to Q1 (of around EUR 60bn/month). 3. Into Q3 we expect the seasonality of issuance to lead to a modest reduction in average pace to EUR 75bn/month in Q3. That being said, as August is typically the month registering the lowest issuance volume, and with a relatively busy issuance pipeline in the coming weeks (notably from the EU), we expect net PEPP flows to remain resilient in the very near term. Simon Freycene